Apps turning market insights into smarter investment strategies

We develop investment applications combining machine learning, and big data with multi-factor investing. AI can provide valuable insights, reduce investment risks and increase the potential for higher returns.

Indicator Investing

Design and evaluate portfolios, indexes, and ETFs through factor-based quantitative analysis.

Stock Ranking

AI-powered stock rankings built on valuation-focused analytical metrics and indicator data.

Investment Strategies

AI-powered strategies that combine multiple quantitative factors to explore performance characteristics observed in historical data.

Indicator Investing

Design and evaluate portfolios, indices, and ETFs through factor-based quantitative analysis.

Stock Ranking

AI-powered stock rankings built on valuation-focused analytical metrics and indicator data.

Investment Strategies

AI-powered strategies that combine multiple quantitative factors to explore performance characteristics observed in historical data.

Investment software automating well-known theories and styles

We algorithmize world-famous investment strategies so that they are not only a theory, but you can apply them in your investment practice.

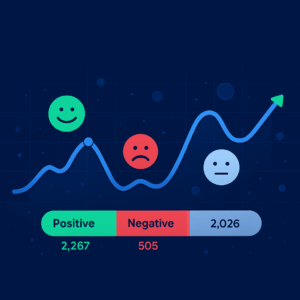

Market Sentiment

Staying informed on current financial news is crucial to maintaining a competitive edge.

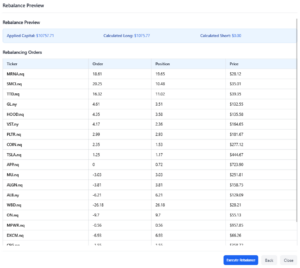

Portfolio Manager

The application brings into practise Markkowitz’s Nobel Prize-winning Modern Portfolio Theory.

Pattern Trading

Building, backtesting and running pattern-based strategies. More than 70 chart patterns.

Market Sentiment

Staying informed on current financial news is crucial to maintaining a competitive edge.

Portfolio Manager

The application brings into practise Markkowitz’s Nobel Prize-winning Modern Portfolio Theory.

Pattern Trading

Building, backtesting and running pattern-based strategies. More than 70 chart patterns.

Market drivers over the past 12 months

See which investment indicators worked best over the past year. Explore factor-based portfolios and adjust the parameters freely — no login required.

Our research on AI and machine learning in investing

Register today & enjoy one month

FREE trial of our application

Gain higher alpha, lower beta, and flawless records of investment decisions

Analytical Platform is a research‑oriented cloud platform designed for exploring financial markets through data, metrics, and quantitative models. It enables analysts, investors, and research teams to systematically study financial instruments and market behavior. Our most powerful domain is the AI-powered multi-factor investment approach.