In this guide we will look at how to fund the Interactive Brokers account for non-US users. The first step after deciding that you want to start trading is funding your brokerage account. All of the Interactive Brokers’ accounts are covered up to USD 500,000 with a cash sub-limit of USD 250,000. The broker charges a small fee for having a cash credit balance exceeding a certain limit in EUR, CHF, SEK, and DKK. Other currencies are not subject to a currency handling fee.

This guide is divided into two sections. In the first section, we are going to show you how to complete the deposit notification and in the second section, we are going to help you with the actual deposit.

How to fund – complete the deposit notification

The deposit notification allows the broker to accurately identify your incoming deposit and credit your account accordingly.

You can either fund your account right after finishing the application process or wait for the broker to verify it first, so you do not risk your deposit being rejected and sent back.

1. If your account is still being verified, you only have to select the “Fund Your Account” button. If you do have a verified account already, you will have to log in, select “Transfer & Pay” from the top menu and then select “Transfer Funds”, and finally select the “Make a Deposit” button.

2. Enter the currency you want to transfer in the “Select the currency you want to deposit” drop-down menu. Next, you choose your deposit method. We will be choosing “Bank Wire” for the purpose of this guide. Finally, select the “Get Instructions” button and fill in the name of your bank and your account number. The “Account Nickname” will be filled in automatically.

3. After you fill in the amount of money you want to deposit, select the “Get Wire Instructions” button to generate your deposit notification.

4. Select the “Finish” button to complete the process. You can find your deposit notification by selecting “Transfer & Pay” and then “Transaction Status & History”. You can download the deposit notification by selecting the “Print” button.

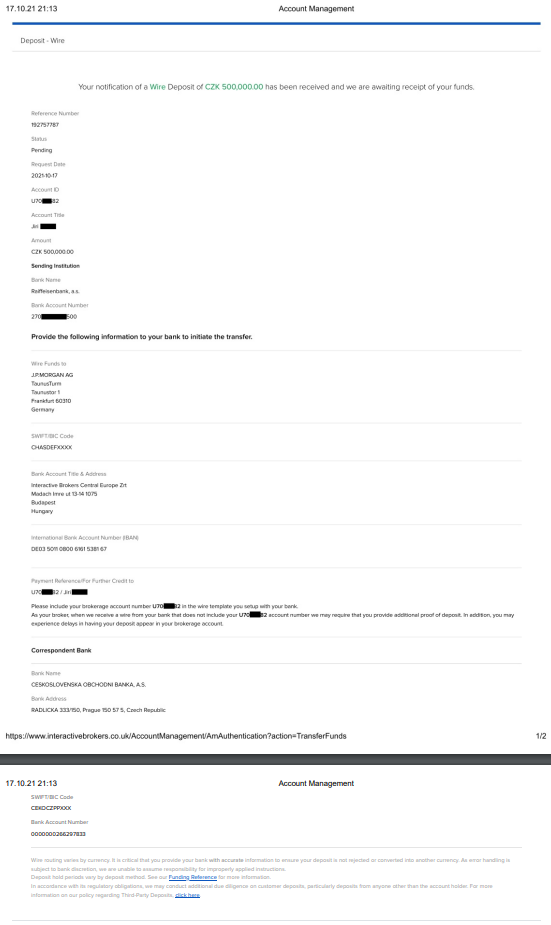

Sample of Wire Instructions in CZK

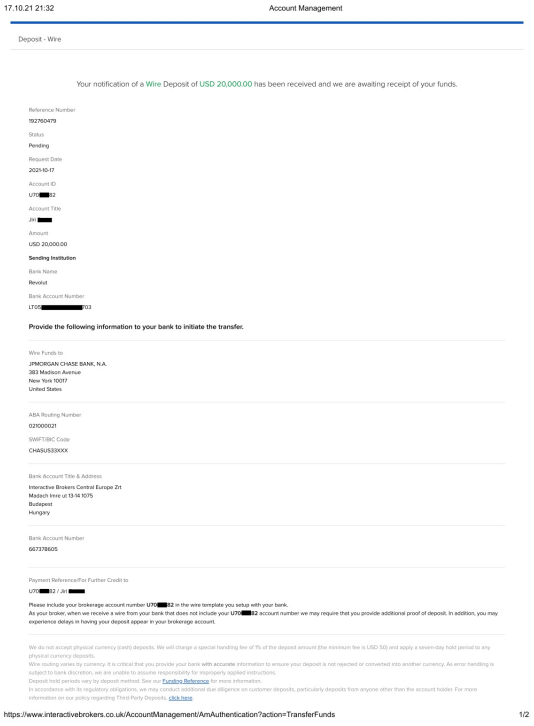

Sample Bank Wire Instructions in USD

How to fund – Depositing funds

The first step is choosing the currency you want to deposit. In this guide, we are going to show you how to send the Czech Korunas and the United States Dollars. The currency you choose to deposit will probably be the same as the currency you selected as your base currency. You can hold any currency you want in your account, but the profits always will be credited in USD when trading US stocks.

1. After logging in to your online banking account, you will have to the enter account number and the payment recipient’s name. If you are based in the CEE (Central and Eastern Europe) region, you will be sending money to the Hungarian branch of IBKR. The name of the recipient is Interactive Brokers Central Europe Zrt, Madach Imre ut 13-14 1075, Budapest, Hungary. The account numbers are:

- Czech Korunas are being deposited in the German branch of J.P.MORGAN AG with the account number DE03 5011 0800 6161 5381 67.

- United States Dollars are being deposited in the JPMORGAN CHASE BANK, N.A. with the account number 021000021 and SWIFT/BIC Code CHASUS33XXX.

2. You will have to choose who is going to pay for the fees that the correspondent bank/intermediary bank is charging. We usually choose that the instructing bank will pay for the fees because your bank will let you know what the fees are charged for these types of transactions. They will include the fees in the bank order itself or have them published in their price list. Usually, it is around CZK 300. Selecting another option than the instructing bank for the fee payment will result in paying higher fees in our experience.

3. It is necessary to enter your IBKR account number into the reference number section because it serves as the payment identifier.

4. You also have to select the purpose of payment. Your bank will usually let you choose from available options such as “financial services”, for example, or let you fill in another purpose manually.

5. Normally, you have your payment credited to your IBKR account during the next business day. You will see your new balance next time you log in to your account. The notification and an e-mail confirmation are sent as well.

You can find all the information mentioned above in your deposit notification. This guide is valid at the date of issue, and all the described information might change in the future. You can find the detailed information here.

The assistance with setting up and funding the IBKR account is included in the IBKR advisory package. If you require any further information or assistance with Interactive Brokers, please do not hesitate to contact us. We hope that this article gave you guidance on how to fund the IBKR account. We also provide state-of-the-art services helping you overperform your benchmark or fill the tax statements easily and fast.