Let’s take a look at the current trending stocks and the factors that have earned the most in previous days. Moreover, learn about statistically significant factors with the potential to deliver long-term returns.

TRENDING TICKERS

MDB

5. 9. 2024

MongoDB’s Q2 financial results impressed investors, leading to a 10% price increase.

ZS

9. 2024

Sentiment is more or less neutral. EPS is up 30 % year-over-year and TAM (total available market) expansion is occurring. However, Zscaler’s full-year outlook is disappointing, which has led to a rating downgrade.

AFRM

3. 9. 2024

Affirm Holdings reported a 48% YoY increase in sales, which led to a steep price hike. The contract with AAPL bodes well for a bright future. However, the failure to achieve focused GAAP could negatively impact it.

ANF

2. 9. 2024

Abercrombie & Fitch reported mixed Q2 earnings with robust comps sales growth but missed gross margin estimates.

HPQ

30.8.2024

Hewlett-Packard’s rating downgraded from Buy to Hold due to inventory build-up and reduced earnings guidance.

For more AI-based concise summaries and useful meta-information, check out our app. You can also follow the daily updates on our X account Market_sentiment.

TRENDING FACTORS ON S&P 100 STOCK UNIVERSE

TOP GAINER FACTOR IN PREVIOUS 5 DAYS

PLUS_DI_44

Plus Directional Movement 44 factor is part of the Directional Movement System and provides a measure of upward price movement. Read more.

Although the market neutral portfolio achieved an excellent result last week, it is a statistically insignificant factor in the long run. However, it performed excellently, for example, from September to December 2000, when it made 35%!

Performance = 5.47%

Signal strength = 0.1

Statistical confidence = 54.3%

Signal direction = ⬀

TOP LOOSER FACTOR IN PREVIOUS 5 DAYS

CurrencyVolume_756

The initial volume of a currency is calculated as the square of the trading volume (Volume) and the closing price (Close). Then, for each time horizon, the moving sum of this currency volume is calculated. This moving sum provides an overview of the cumulative currency volume over different time periods.

Performance = -6.54%

Signal strength = 3.29

Statistical confidence = 99.94%

Signal direction = ⬂

Register today & enjoy one month

FREE trial of our application

STRONG AND STATISTICALLY CONFIDENT FACTOR

We don’t have to look for any other factor this month because CurrencyVolume_756 is statistically significant.

Let’s look at the factor in more detail.

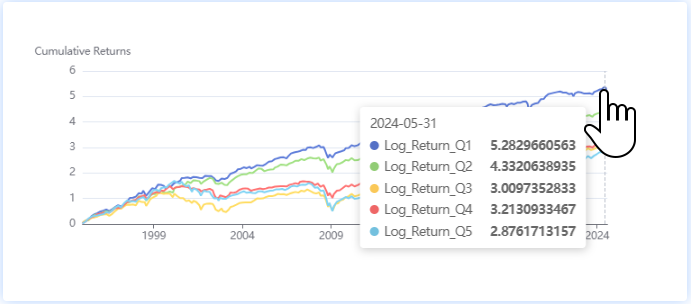

We analyzed the indicator and found that the most growing stocks in the long-term are those with the lowest value for the factor. This gives us the Signal direction. With this knowledge, we are ready to build our factor strategy/ portfolio. In our Factor Investing app, we can test any settings.

Sample strategy and backtest parameters:

Built on factor model: CurrencyVolume_756

The portfolio consist of the top 20 assets ranked by the model.

The strategy is using leverage 2 for the invested capital.

60% of the capital is invested uniformly as long positions in the stocks with the lowest factor loading.

40% of the capital is invested uniformly as short positions in the stocks with the highest factor loading.

0% of the capital is left as cash reserve.

The period shown begins at: 2020-01-01 and ends at 2024-09-04

Capital of $100000 is initially invested into the strategy.

Multi-period walk-forward out of sample method. This method provides greatest integrity and predictability results. Performance is calculated with end-of-day closing prices. Backtests calculates 0 fees per trade. Dividends are included in cumulative performance, as if they were continuously re-invested.

Equity of strategy and benchmark

And what are the results? In the chart we can see the comparison between our strategy’s equity and the universe, i.e. the values of the S&P100 index. We can also look at the Sharpe Ratio, Volatility and CAGR values. The application provides a number of other metrics for assessing the quality of the strategy.