Factor-based indexes and ETFs are gaining unprecedented popularity. Assets Under Management (AUM) in them have grown 22 times in the last 5 years! What factor-based indexes are, including interesting statistics, is nicely described in the article Importance of investing in factor based index funds.

Why are factor indexes/ETFs formed at all?

Factors have demonstrated the ability to deliver excess returns or lower volatility compared to passive market cap-weighted indexes. Those are characteristics that active fund managers consistently look for in their research. In this article, I will present how portfolio managers can easily achieve their goals through factor investing.

Portfolio managers may have different objectives. For simplicity, let’s say an investment analyst wants to maximize profits at a similar volatility to its benchmark. We can create single or multifactor portfolios, I will demonstrate the differences in the next paragraphs.

How to create and manage a single-factor index

Factor selection

To maximize profits, first, we must select an indicator/ratio/factor capable of delivering an excess return.

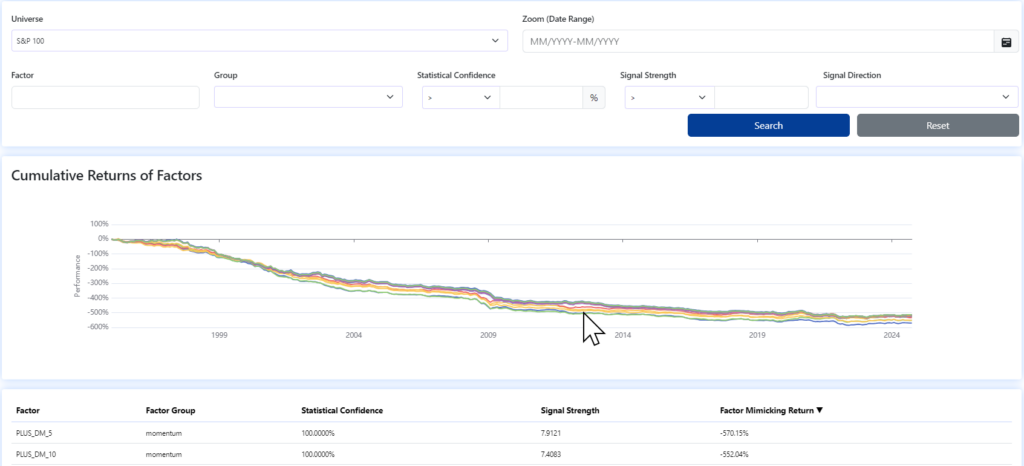

One way is to try Factor Mimicking and select the factor with the highest return or the biggest loss[1].

By default, we test the indicators on a 30-year period. However, it is a good practice to zoom in and test the factor for a shorter period too.

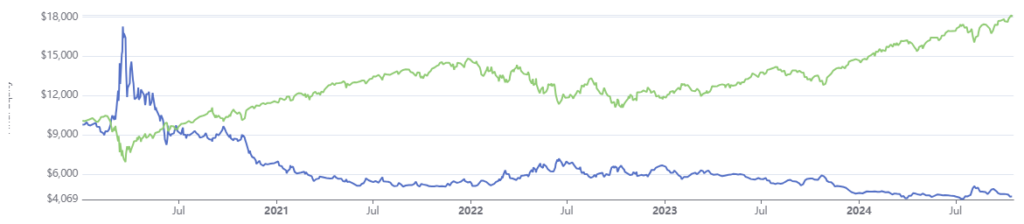

In this manner, we have selected, for example, the PLUS_DM_3 factor[2]. This factor has a long track record of outstanding performance and has continued to perform well over the last 4 years. The factor has a downward Signal direction. That means the stocks with the lowest score grow faster than those with the highest score in the long run.

Strategy/Index/ETF creation

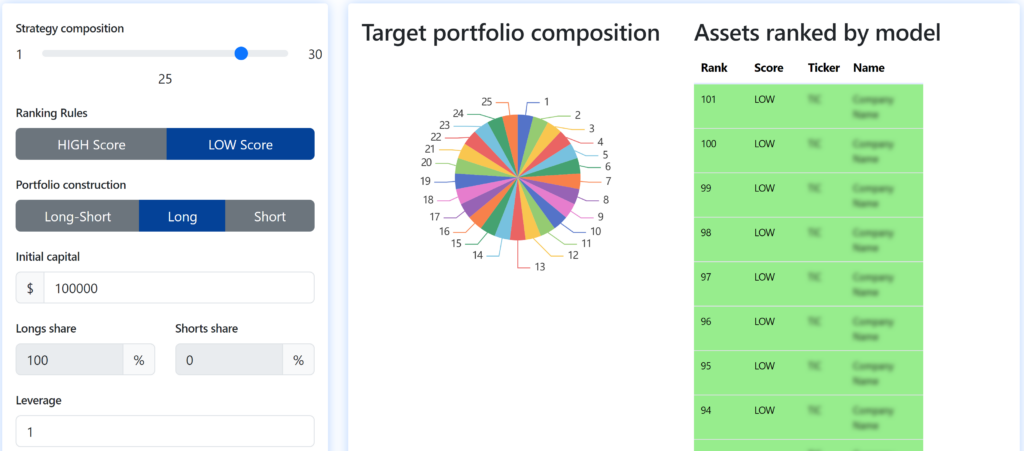

In the next step, we create an index strategy, i.e. define the rules for selecting stocks for the portfolio.

We have already decided to have a portfolio with similar volatility to our benchmark. At the same time, we know that we don’t want short positions in the portfolio. With these input parameters, we can play with the number of stocks in the portfolio and the leverage.

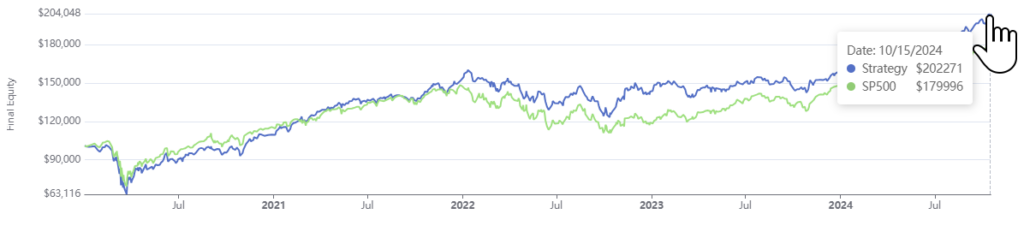

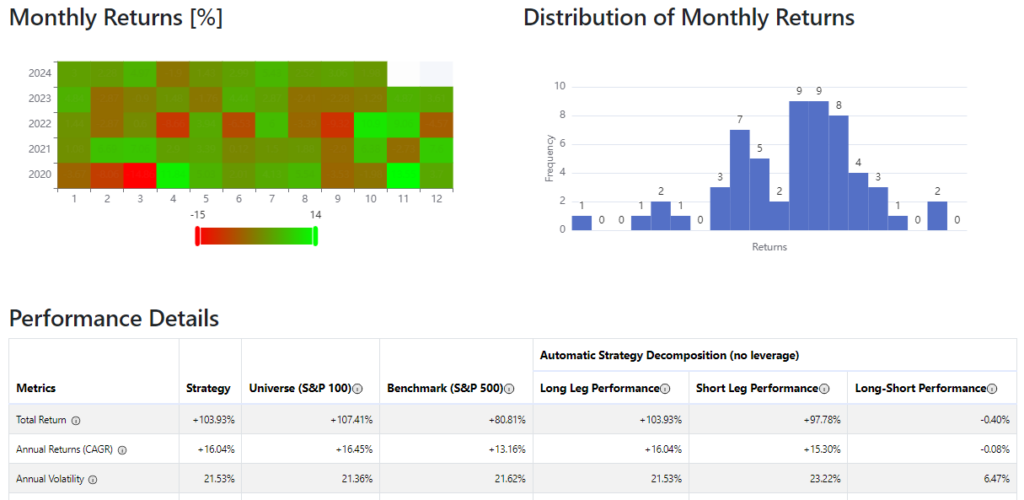

This will give us the optimal setup where we are satisfied with the performance and financial ratios of the portfolio. In the sample case, we performed best by holding 25 stocks in Long positions.

Such a strategy would have outperformed the benchmark over the last 4 years. The WinRate of individual trades was 66% and the Annual Volatility was slightly lower than the benchmark. To define a future factor ETF/index, we can use several additional indicators available in our application.

Portfolio creation and adjustment

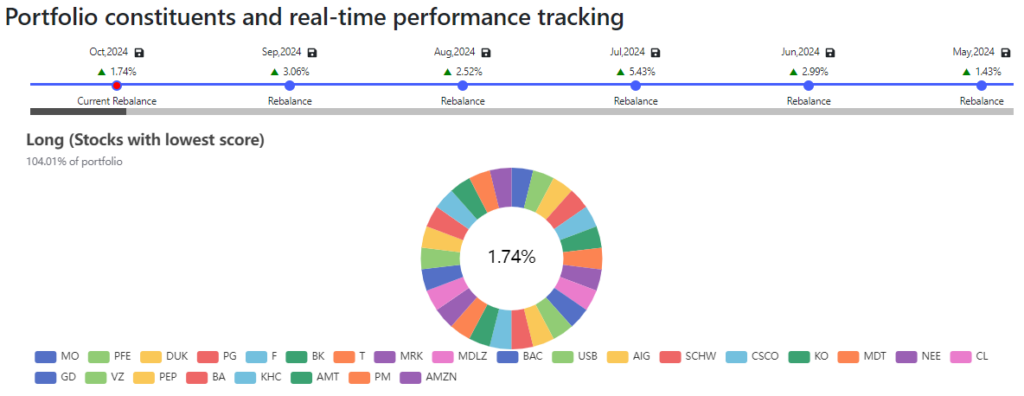

In the last step, we look at the current portfolio/ETF/Index composition, which means selecting the stocks that have the lowest value of the selected factor on the current date.

We will purchase the above-displayed stocks for our ETF. Monthly, we will adjust holdings according to the newly ranked list of stocks. The current stock valuation by factor determines the current index/ETF composition. However, if the stocks we currently hold are still achieving good scores, we may make only minor adjustments. For this purpose, we can use a list of all the stocks from our universe that are sorted by factor loading value (the floppy disk symbol).

How to create and manage a multi-factor ETF

1) The easiest way to create a multi-factor Long Only Index/ETF is to complement the above single-factor portfolio with stocks that appropriately adjust our desired portfolio/index parameters.

For example, we might say that we want to reduce the volatility of a single-factor portfolio. Therefore, we will buy additional stocks according to another factor that performs exactly in the opposite way compared to the first factor. For example, the Free cash flow factor, where we will long the 5 stocks with the highest value for the factor. Note the inversion of the equity curve compared to the DM factor.

We want to reduce volatility by, for illustration, 25%. So we will limit the original portfolio to 75% of capital. Newly we will invest 25% of capital in 5 stocks according to the factor Free cash flow that meets the requirements defined above. Thus, we will always hold 25-30 stocks in the portfolio. In certain situations (although unlikely), the same ranking may be given to stocks in both factors.

2) Another approach for creating a multi-factor portfolio is to multiply the stock scores for each factor by the ratios given (75%/25%) and create a new list of stocks based on the combined values.

3) The most advanced, AI-powered multi-factor investing approach selects uncorrelated factors and combines them to form an ideal portfolio/index/ETF.

In the current version of our Factor investing application, we support method 1. We are intensively working on making available the techniques introduced in points 2 and 3 so that we can also offer you comprehensive tools for creating multi-factor portfolios. On this page, you can see how we create our AI-powered multi-factor investment model for the Stockpicking Lab. With the above logic, we will provide you, our users, with the ability to create multi-factor models.

How can we help you with factor-based indexes/ ETFs?

At Analytical Platform, we have developed software that allows portfolio managers to easily create and manage factor indexes. Our application currently supports more than 1,000 factors and provides a tool for comprehensive portfolio management. Starting with the selection and testing of appropriate factors/indicators, through the creation of a factor strategy, all the way to portfolio rebalancing. For more information on the full capabilities of the application, see How to apply Factor investing software.

Register today & enjoy one month

FREE trial of our application

[1] For factors with the biggest loss, we can simply long the stocks with the lowest factor value.

[2] Plus Directional Movement is part of the Directional Movement System and provides a measure of upward price movement.