Discover the power of AI

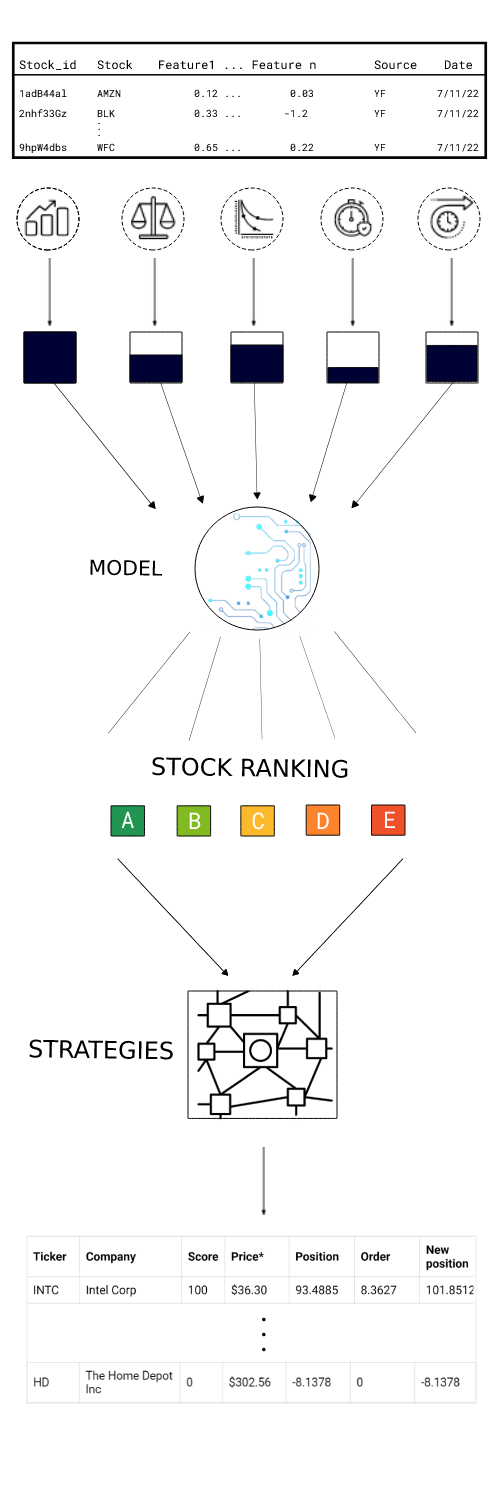

Our multi-factor model uses machine learning, data analysis, and AI principles to rate stocks based on their expected risk-adjusted returns. It takes the values of the most relevant indicators into account to evaluate individual companies.

We have developed our multi-factor investment model for market inefficiency exploitation (researchers call it no-arbitrage condition violation). The risk-adjusted return measures the profit your investment has made relative to the amount of risk the investment has represented throughout a given period of time. If two or more investments have delivered the same return over a given time period, the one that has the lowest risk will have a better risk-adjusted return.

The model estimates the normalized return of the monitored stock. There are nine submodels. Thereupon, all of them are estimated on the cross-sectional dataset of NxT size and tested with: linear ridge regression, elastic-net linear regression, a feed-forward neural network with continuous targets, elastic-net logistic regression, and a feed-forward neural network with binary targets.

A simplified description of the creation of an AI-powered multi-factor investment model

Finding the most relevant indicators

Downloading the financial data

We download all the available fundamental, macroeconomic and price data for the last 30 years. Whereas, the data are sourced from various publicly available data sources.

Calculating the values of indicators/factors

The model uses the downloaded data to calculate the values of 2237 different factors. Each of them belongs to one of these five categories of indicators: value, growth, volume, long term or short-term price dynamics. In the value category are indicators that track the relation between stocks’ price and their intrinsic value. Growth indicators are those that measure the potential of a company to generate cash flows. Volume indicators describe how many shares or their dollar value are being traded. Long-term price dynamics indicators describe stocks’ price behaviour over long periods such as months and years. Short term price dynamics indicators describe stocks’ price behaviour over short periods such as days and weeks.

Selecting the most relevant indicators

The model compares all the indicators with each other to select a smaller number of them that will be used to rank individual stocks later on.

Removing highly correlated indicators

In the case of two indicators showing similar results, the model will exclude one of them.

Determining the relevance of each factor

Assigning weight to indicators

The model calculates the percentage weight that each factor should have based on its relevance.

Producing the final output

Calculating the score

Based on the values of the indicators,we calculate the score for each stock on the list.

Testing

The model validates whether the stocks performed according to the assigned score.

Uploading

The score of each stock is uploaded to the Analytical Platform web application.

Describing

The output of our model is ranked list of stocks with their score numbers. Stocks with a higher score have more potential to grow in value in the given forecast period, compared relatively to other stocks from S&P 100. You can see the actual score of stocks index in our web application.

Using the final multi-factor model

Stock ranking

Find the best investment opportunities on the market right now. Chiefly, use our AP score and pick the best performing stocks into your portfolio.

Investment strategies

There is no such thing as guaranteed success in investing, but there are several ways to improve your odds. However, we have created AI-powered multi-factor investment strategies that outperform the stock market. Choose the right investment strategy for you and our automated software will manage everything else.