Using R-squared in the evaluation of investment indicators

Following industry standards, our Analytical Platform application facilitates the assessment of factors based on the difference between the performance of quantiles.

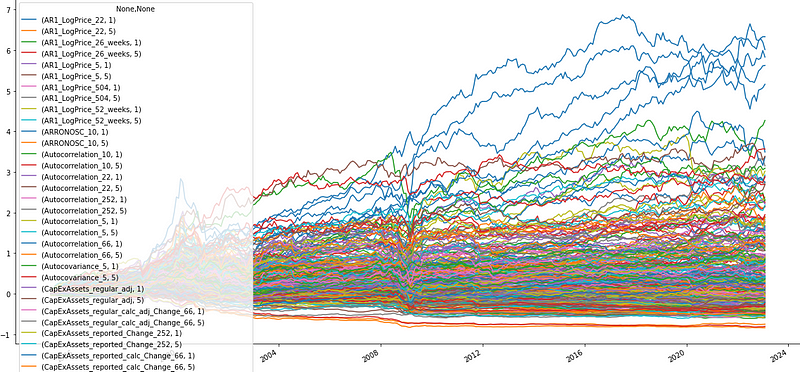

R2 can help us to understand how much the smaller/real portfolio (Long/Short 20/20) matches the characteristics of the larger portfolio (Long/Short 100/100) on which the factor is being evaluated in the first step.