What are trends in factor investing

Factor investing, factor-based portfolios and the use of Machine Learning for Factor investing is an increasingly resonating trend in the investment industry. Books such as Machine Learning for Factor Investing: R Version or Equity smart beta and factor investing for practitioners are influential.

Factor investing is often associated with ETFs (exchange-traded funds). Customized indexes can be easily created and managed using factors and the rules they govern. There are multiple popular videos in which authors touch on the multifactor investing area, such as Five Factor Investing with ETFs.

Much has been written about what factor investing is, what Size or Quality factors for example are. Likewise, you can find numerous articles on how you can try to create factor portfolios with programming knowledge. You can learn about terms like Z-score, or what mistakes not to make when creating factor models.

These publications are very useful for companies with large analytics and programming teams that are able to dedicate internal capacity to create Factor-based portfolios for their clients.

However, a typical investment company does not usually have such capability. This article has been drafted for these entity types and the professional investing community interested in factor investing. I want to show how factor portfolios can be created using automation for ordinary portfolio managers nowadays.

So let’s dispense with theory and programming, and get down to what portfolio/wealth managers or investors are interested in. It means creating an optimal investment strategy and knowing which stocks to invest in at the moment.

Creation of a factor-based investment portfolio

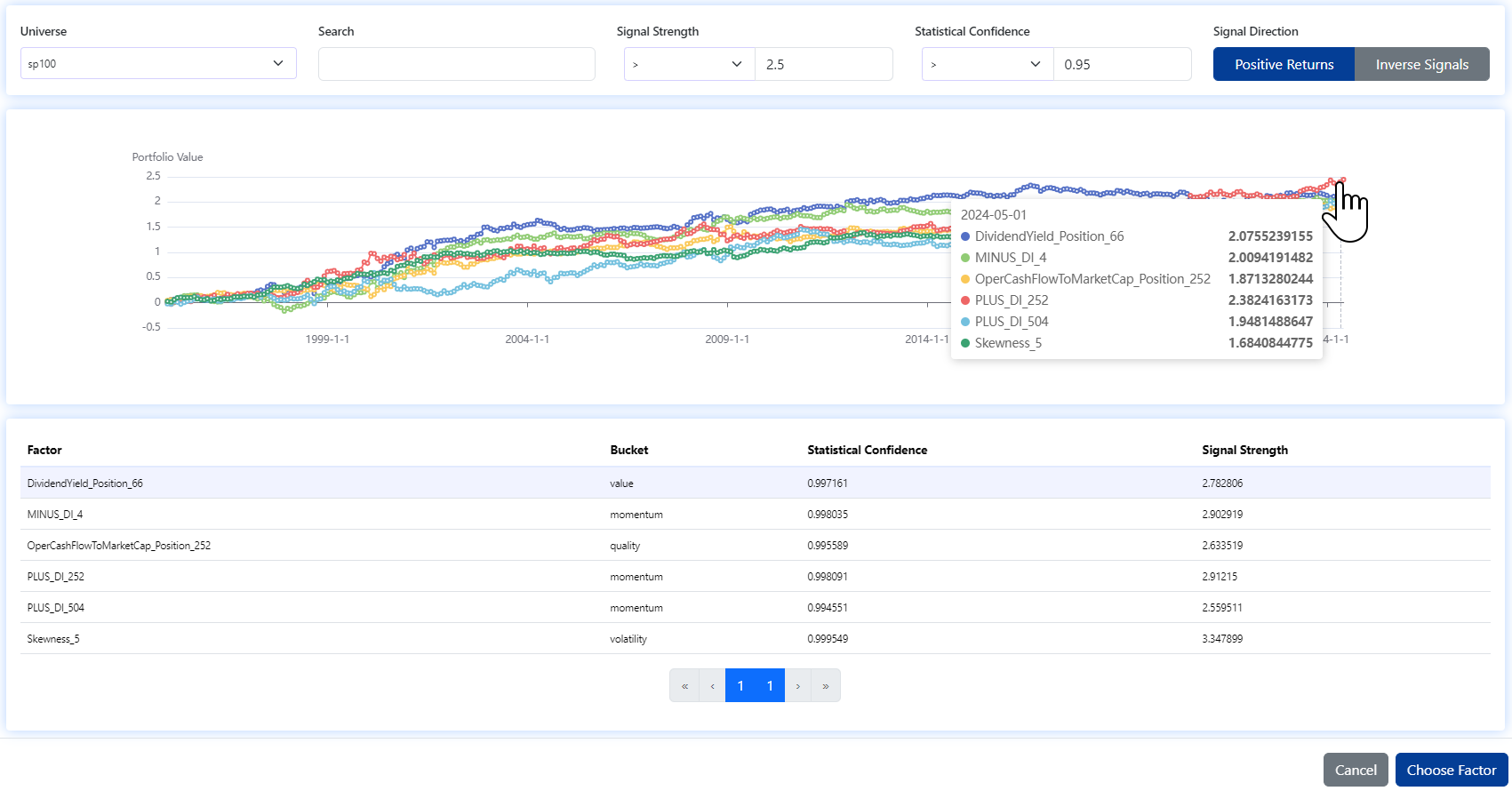

Selection of an appropriate investment indicator/factor

The first step is to select the factor/indicator/ratio (model in the case of multi-factor portfolios). For the sake of simplicity, we will not deal with multi-factor portfolios in this article; instead, we will focus on single-factor portfolios. Multi-factor models combine factors together, however, in principle, the process is the same.

Number of investment factors known

There are many indicators/ratios/metrics, in our terminology factors, that can be used to value stocks. There are more than 10,000 such factors known.

Statistically significant factors

Many ‘genius investors’ claim to have found a factor that is guaranteed to work in most time periods. Or they can mix factors (Multi-factor investing) to create a robust investment strategy.

At this moment we should be on guard! Just because a factor/indicator has worked in a certain time (=stocks that performed well in it grew faster than others) does not mean that it will continue to perform. This is where the use of statistics comes into play.

To select reliable factors, it is worth taking only those with good T-Statistic and P-Value values. Of course, using these ratios does not guarantee that the factor will continue to work. However, you’re doing the best you can.

To assess the factor utility, the following indicators are also used. For example:

- Return Analysis reflecting the performance of each quantile according to the factor loadings at each rebalancing.

- Model Error Analysis showing the R2 between predicted returns and actual observed returns.

- Mean Absolute Error (MAE) between predicted returns and actual observed returns.

Creation of a factor-based investment strategy

First, it is important to understand that the portfolio manager does not analyze individual stocks, but rather chooses to seek out stocks that have the best (or worst) values in a given factor.

For the factor that we previously analyzed as suitable for our investment strategy, we subsequently choose the rules for selecting stocks for the portfolio. The simplest thing we can do is to create our own ‘factor index’. For example, an index based on the CapEx (Quality factor group) factor. This factor performs well statistically in the long term. We found that the stocks with the lowest CapEx value (Q1) grow faster than those with a higher CapeX value.

The Factor Index simply checks which stocks are currently achieving the worst CapEx values at regular intervals. The factor investing application makes adjustments to the portfolio accordingly. For example, we may compose our portfolio of 5 stocks and adjust the composition once a quarter.

Development of Smart beta strategy

More exciting is the use of short positions or leverage to create Smart beta portfolios. In this way, it is possible to find and backtest the optimal strategy based on factors.

For this purpose, we select the number of stocks included in the portfolio. We use the ordering of stocks according to the highest/lowest factor loading. Also, we can set up the value of Long/Short positions in the portfolio and the value of leverage.

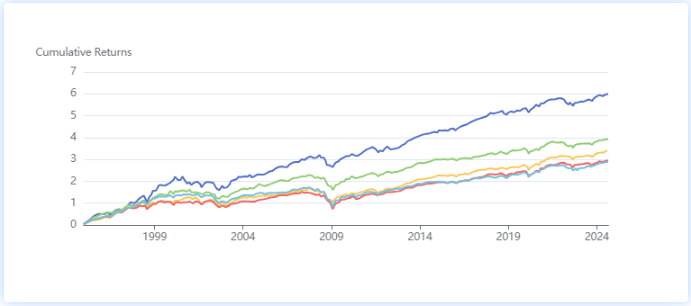

Assessing the performance of the factor strategy

The first thing the majority of the general population expects from a successful investment strategy is a higher final equity value compared to the benchmark.

The more experienced ones try to optimize other parameters of the strategy. Several metrics are used for this purpose. In our case, we evaluate strategies by Final Equity, Volatility, Sharpe Ratio, Alpha and Beta versus Universe, CAGR, Max-Drawdown, Average-Drawdown, Win-Rate, Skewness, Kurtois, VaR95, CVaR95, Calmar, Sterling, Sortino, as well as Percentage/Absolute Monthly Returns.

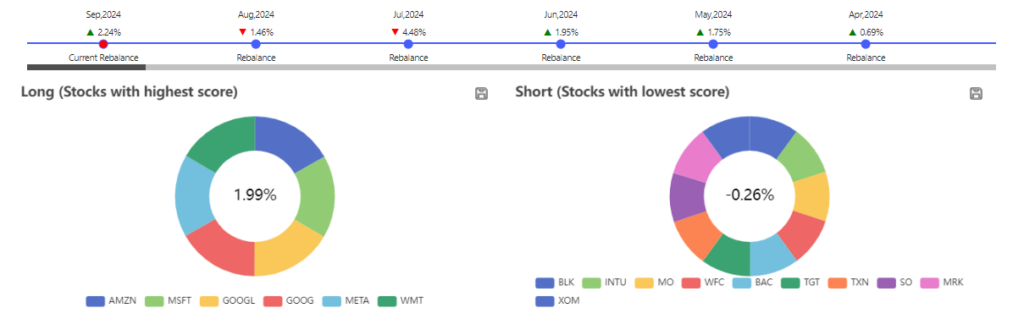

Portfolio constituents and real-time performance tracking

We have selected the appropriate factor/model and tested our strategy. Now we come to the most important part, we want to know what our ideal investment portfolio should look like.

Our software collects data on individual companies at regular intervals, calculates the value of indicators/factors, and creates a ranking of stocks. At any given moment, we can see which stocks have the highest or lowest value for a factor and also how the stocks in our portfolio are doing. With this knowledge, we can adjust our portfolio/index appropriately. We are also able to explain transparently to clients and regulators how the portfolio is constructed.

Summary on the use of factor investing for portfolio construction in practice

In my article, I describe how factor investing portfolios can be built and managed using the cloud-based Analytical Platform application. It is not just about the theory or how-to guides on scripting a factor model, but about the real-world application of factor investing in practice. For more detailed information on how our approach technically works or what the limitations are, I would be happy to hear from you.

Register today & enjoy one month

FREE trial of our application