Analytical Platform brings software supporting the comprehensive process of factor investing.

- Easily test multiple factors/factor models.

- Build and backtest investment strategies based on the desired factors.

- Instantly update the stock portfolio/index according to the tested strategy.

Let’s see how our software works.

1) Factor model selection

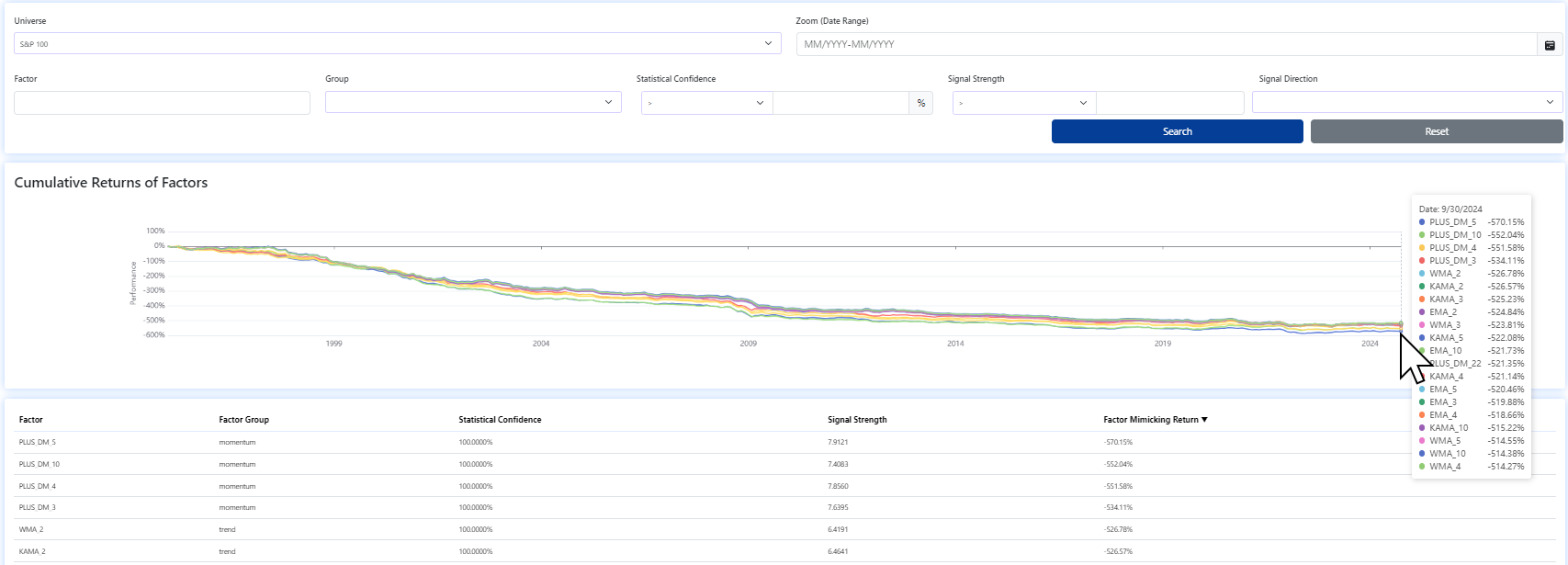

In the first step, we identify statistically significant factors upon which we can build investment strategies in the next step.

Factors coverage

There are more than 1000 factors to choose from.

Factor analysis

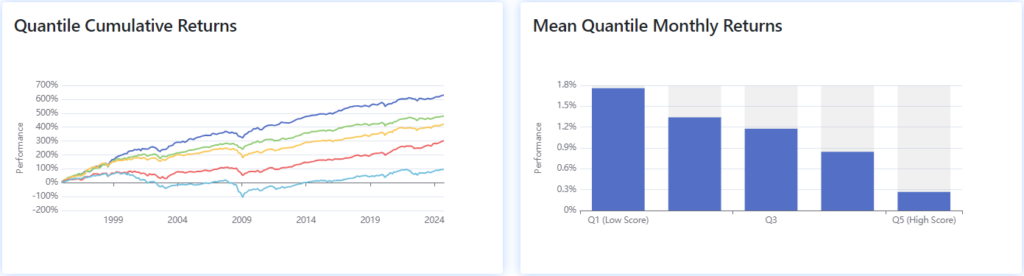

LongShort portfolio represents a beta-neutral portfolio of the top and bottom stocks rated by the factor. The application also provides the Return analysis reflecting the performance of individual quantiles by factor loadings at each rebalancing.

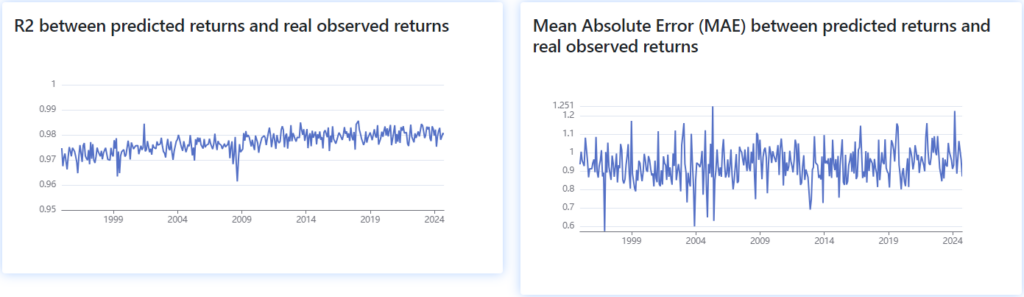

Additionally, Model error analysis is provided, which expresses insight into how model performance changes over time on normalized data, read more.

Once we have selected a suitable factor model, we can proceed to the second step, which is the creation of an investment strategy.

2) Investment strategy creation

Investment strategy parameters setting

Strategy backtesting

In the next step, we get the results of backtesting the formed strategy. Firstly, we can see a graph showing how the value of capital has changed over the backtested period, followed by more than 20 metrics to assess the performance of the strategy.

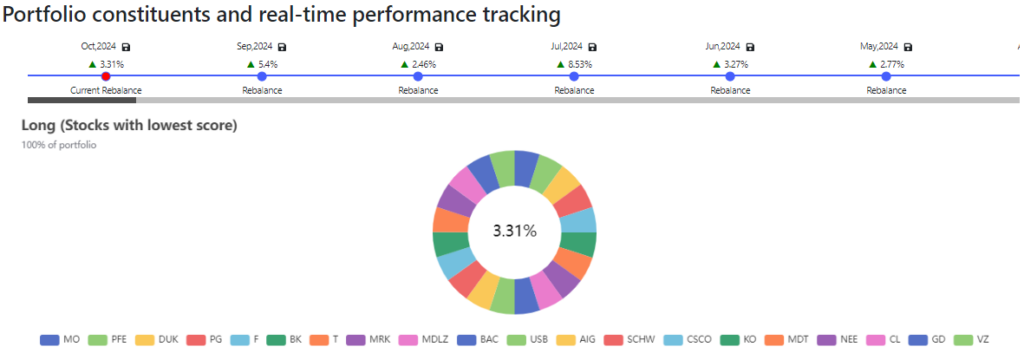

3) Investment strategy deployment and optimal portfolio building

Once we have developed a suitable investment strategy, we are interested in which stocks we should currently invest in. Furthermore, we want to track the performance of our strategy in real operations.

In the Portfolio constituents section, we see both Past portfolio holdings and most importantly Current portfolio constituents, i.e. the stocks we should currently hold in the portfolio.

Real-time portfolio tracking

To monitor the performance of the strategy, we use the Real-time portfolio tracking feature, where we can see the portfolio performance since its last modification and the overall performance since the strategy was put into live operation.

Portfolio adjustment alerts

Users also receive Portfolio adjustment alerts (email + app notification) that indicate the rebalance needs to comply with the backtest rules. In other words, the user receives information that the ideal portfolio has been recalculated and that they should adjust it.

AI-powered software delivers better results

AI stock analysis & Powerful investment strategies