Signal direction understanding

For building investment strategies, it is important to understand that factor models can indicate two signal directions. The direction of the signal simply tells us whether the performance of the LongShort portfolio reaches plus values or vice versa. In other words, the signal is up when stocks with the highest indicator values beat those with the lowest ones.

Once we have clarity, we can proceed to the portfolio creation by running the backtest of the strategy.

Back-test settings

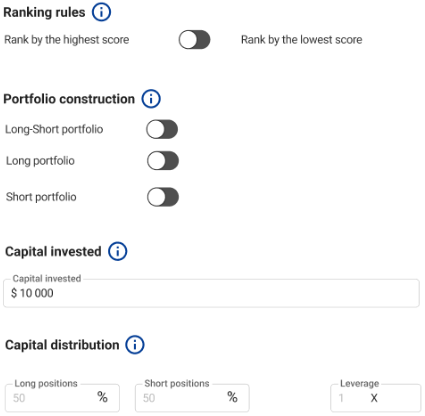

In the app we can select:

Sorting stocks by the highest score

If we have ranked stocks by the highest score, portfolio construction is intuitive.

- Long portfolio means that we buy the stocks with the highest values for the factor.

- Short portfolio means that we sell the stocks with the lowest value for the factor.

- Long-Short portfolio combines the above. We calculate the performance of stocks in the quantile with the highest loading of factor and subtract from it the performance of stocks in the quantile with the lowest loading of factor.

Ranking stocks by the lowest score

The app also allows this interesting approach to creating an optimal portfolio.

- Long portfolio means that we buy stocks with the lowest value for a factor (for example, we want to buy the least volatile stocks).

- Short portfolio means that we sell the stock with the highest value for the factor (for example, we want to sell the most volatile stocks).

- A Long-Short portfolio, again, combines the above.