Artificial Intelligence (AI) in the stock market industry could be a game changer, allowing investors to make data-driven investment decisions without any bias.

I’ve always been intrigued by leveraging the power of artificial intelligence for stock market analysis and for building investment strategies. Let’s explore how artificial intelligence can help with stock analysis, factor investing, and searching for undervalued assets.

Understanding the role of AI in stock analysis

Artificial intelligence is an advanced technology, which allows machines to learn from data, make decisions and mimic human abilities. In stock analysis and investment strategies, AI uses machine learning algorithms to evaluate financial data and market trends. The advantage of AI is its ability to process large volumes of data. Thanks to that, it’s able to identify patterns, trends, and opportunities, which human analysts may miss. This means AI can provide investors with useful insights and recommendations, that they may not discovered otherwise.

How to identify assets that outperform the market

Before we start with the actual machine learning, we first need to define our goal and the use case that we want to achieve.

A typical goal in stock market analysis is to find assets with higher risk-adjusted returns than the overall market. For a specific case, we need to first define what market are we interested in. So let’s define the market as the S&P 500 index. Once we have the market selected, we can say our market represents the average value of the 500 largest US companies.

Subsequently, our goal is to evaluate all the companies and select those that perform better than the average. With such a use case, the AI can consequently analyze all available factors and identify assets that perform better than the average. The most commonly used classes of factors typically include a company’s financial performance, industry trends, and macroeconomic conditions.

Technical Analysis with AI: Identifying patterns in the market

Technical analysis is the process of analyzing market trends and price patterns to determine future market movements. Common technical indicators include, for instance, moving averages, price momentum, or the Relative Strength Index (RSI). Artificial intelligence is able to process technical indicators in real-time. Thanks to that, it identify potential investment opportunities and market trends that might otherwise be missed by human analysts.

Fundamental Analysis with AI: Making sense of financial statements

Fundamental analysis is the process of analyzing a company’s financial statements to determine its value. AI can sift through financial statements and identify trends and patterns that may indicate undervalued assets. Additionally, AI can process other factors such as industry trends and economic conditions. By enriching these other factors, AI can then provide a more comprehensive analysis of a company’s value. With real-time processing, AI can provide up-to-date information on a company’s financial performance.

All that is designed for one goal, to allow investors to make informed decisions based on the latest financial data.

Factor Investing with AI: A Match Made in Heaven?

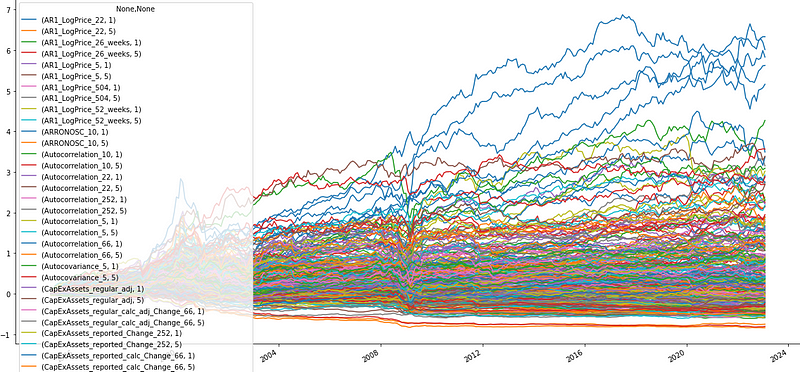

Factor investing is the process of investing in stocks based on specific factors such as company size, price momentum, or interest rates. There are more than 10,000 financial indicators available and new ones are constantly being developed. Factors take into account not only company-specific data such as fundamentals but often also include macroeconomic market conditions.

Analyzing of such large volumes of indicators is a perfect use for machine learning, as it can quickly identify stocks that meet certain criteria. For instance, it can quickly select stocks with a high dividend yield or a low price-to-earnings ratio, or even a combination of several criteria.

In addition, artificial intelligence is great for finding those factors that influence asset performance the most. Thus it’s especially easy for AI to ignore irrelevant factors, so investors don’t have to deal with useless data or noise. It becomes apparent that AI can undoubtedly save investors and analysts a lot of time. Moreover, it can help them avoid costly mistakes by omitting factors that are not actually relevant.

AI-powered software delivers better results

AI stock analysis & Powerful investment strategies

Stocks Ranking with AI: How Does It Work?

The simplest way to rank stocks is based on specific criteria, such as market capitalization or earnings growth. However, the real benefits come from compounding several factors. The desire is to make stand out those stocks, that fit desired parameters. This can be illustrated on a case where i am looking for a quality stock with good financial health while its price momentum is on the rise. Such a stock will be ranked higher than a stock whose price is already at its peak and therefore has less upside potential.

The above advantages can be greatly amplified by using machine learning. AI can very efficiently select only the best-performing factors out of thousands. Simultaneously, it can adjust the weights of each factor based on its actual relevance. As a result, it is then possible to compile an overall score based on a combination of the best factors. The highest scores then represent assets that perform better than those with lower scores.

The real power of AI in stock market analysis lies in its ability to combine technical analysis, fundamental analysis, and factor investing together to achieve that goal we have set previously: ‘to identify assets that outperform the market’.

The transformative potential of AI for investment strategies

Investors who want to get a head start should consider incorporating Artificial intelligence into their investment strategies. AI can provide valuable insights and recommendations for investment opportunities, reducing investment risk and increasing the potential for higher returns. Investors often have different preferences and world views, which they want to incorporate into their strategies. Whether it’s about specific geographic markets, environmental or social aspects, AI can adapt to these requirements and adjust accordingly.

Since everything is data-driven, it’s particularly easy to break down the whole process to see which factors play a major role and how they affect the overall score. In this way, it can be clearly demonstrated what are the strengths and weaknesses of each asset. Each decision is automatically documented and supported by data. Such a report, for instance, might be particularly interesting to various investment committees or supervisors.

Want to see AI-driven investment in action?

At Analytical Platform we specialize in practical use of AI in financial markets. We provide stock analysis, we improve portfolios, we summarize financial news, and we extract sentiment and trends. All that so investors won’t miss anything important. We also actively trade quantitative strategies on the stock market.

Contact us today or request a demo to learn more about AI-driven investment strategies.