StockPicking Lab

Software for Application of AI-powered Investment Strategies Based on Factor Investing

About StockPicking Lab

Maximize your investments with StockPicking Lab – AI-powered solutions. Trust in our tried-and-true strategies, leveraging the power of artificial intelligence and multi-factor investing. Get the insights you need to make informed stock decisions and achieve better investment results.

What are the benefits for you?

Discover the value of each rated stock with our comprehensive evaluation system, including over 1000 financial indicators and relevant metadata.

Based on the stock ranking, we provide automated investment strategies that outperform the S&P 500 benchmark.

Is your portfolio really well collected? Compare it with the efficient frontier. With our application you can easily determine whether your portfolio is well-balanced and if rebalancing could increase returns or decrease risk.

Application provides you with the ability to set specific limitations such as minimum or maximum weight for stocks in the portfolio, presence of arbitrary stock, or the maximum number of companies included in the portfolio.

Maximize Your Returns with AI-Powered Investment Strategies by StockPicking Lab!

Register today and enjoy a complimentary one-month FREE trial of our application!

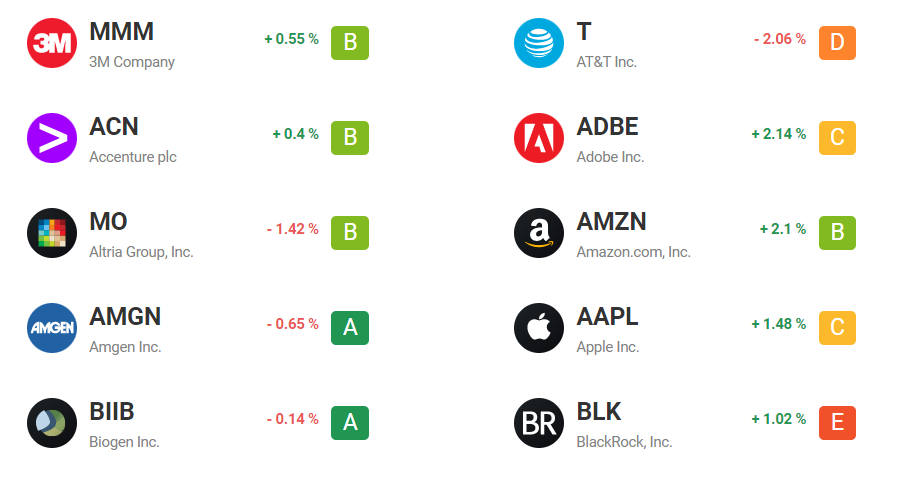

Discover the value of undervalued & overvalued stocks with StockPicking Lab’s stock ranking system.

Stock ranking

Discover our AI’s “Stock-Selection” process, which evaluates each stock based on over 1000 financial indicators. Our AI creates a ranked list of stocks, from most undervalued (A mark) to most overvalued (E mark), giving you a comprehensive view of each stock’s growth potential and risk.

A mark

Take advantage of the growth potential of the most undervalued stocks with our AI’s stock ranking system. Although the A mark indicates high growth potential, it doesn’t guarantee consistent outperforming of overvalued stocks.

E mark

Explore stocks with lower declines and consider their potential with our AI’s E mark. The E mark for a stock doesn’t automatically imply bearishness, but it does give you insight into the stock’s performance compared to others.

Don’t settle for a single stock. Our AI’s stock ranking system, proven through backtesting and live trading, suggests diversifying your portfolio for long-term investing success. Use our rankings to build a robust and well-balanced portfolio, and consider monthly rebalancing to stay on track.

Investment Strategies

AI-powered investment strategies deliver higher performance, minimize drawdowns, and eliminate loss periods. Our strategies are based on multi-factor models and invest in the largest publicly traded American companies from the S&P 500 index. The value of these companies has grown steadily over the last 13 years, representing an average of 9.04% per year.

AP US Large-Cap Hedged 1.5X Share

Aims to outperform the S&P 500 in risk-adjusted return, achieving above-average returns and low volatility.

Two-and-a-half times lower max drawdown than S&P 500.

AP US Large-Cap Aggressive

Aims to outperform the S&P 500 in absolute return while taking similar risks, achieving high return and average volatility.

Two times higher performance than S&P 500.

How to use AI-powered Investment Strategies?

Strategies use stock ranking to build a portfolio and every month the portfolio is rebalanced to conform the current ranking. Without regular rebalancing the portfolio becomes obsolete and is no longer driven by fresh data. To simplify the process, we have developed rebalancing application, so you can keep your portfolio up-to-date within 10 minutes every month. Currently we support Interactive Brokers as one the biggest brokers in the world. Apart from generating market orders for your IBKR account, the rebalancing application also generates PDF with long and short positions of the current portfolio. That can be used to manually set the same positions with any other broker.

The strategies are designed for long-term investing with regular rebalancing and they don’t necessarily beat the market every single month. The effect of long term investing might take year or even more to become apparent.