Tax Application

Calculate Your Investment Taxes in Minutes

Tax Calculation Application

Automated investment tax calculation in minutes

ABOUT TAX CALCULATION APP

It is no longer necessary to spend countless hours manually reading reports and studying tax issues, either by you or by your tax advisor. Foreign users of Interactive Brokers (IBKR) face the problem of how to properly prepare tax returns on their investment activities. We are answering this by creating a tax application that allows you to calculate your taxes in minutes.

The application is provided free of charge. It is an additional service, convenient for using our main applications. These are used for making the right investment decisions and applying advanced AI-powered investment strategies.

WHAT ARE THE BENEFITS FOR YOU?

An easy-to-understand PDF document that will give you all the items needed to complete your tax return.

Report in the user’s native language according to the government’s requirements.

An easy-to-understand PDF document that will give you all the items needed to complete your tax return.

Report in the user’s native language according to the government’s requirements.

Calculate your investment taxes in minutes

Generate a flawless report for the tax office and save tons of time

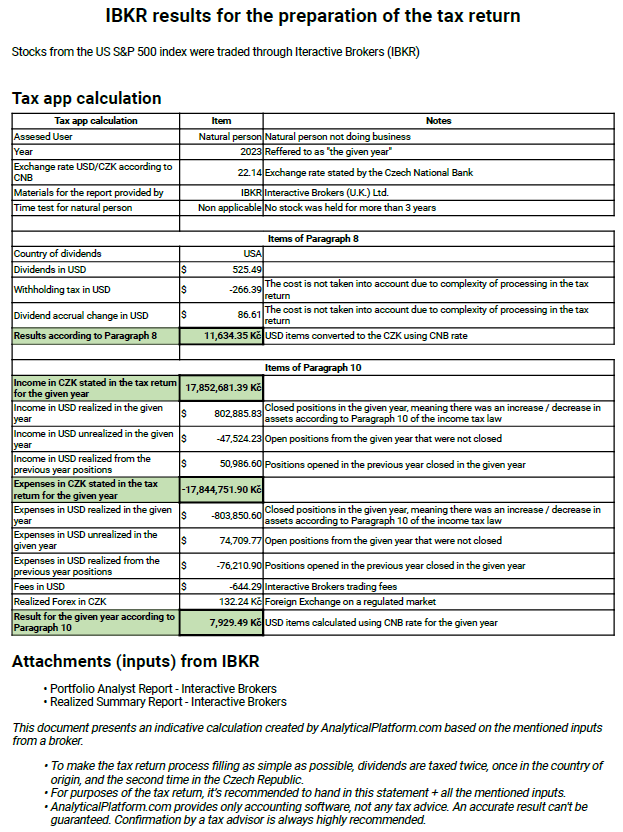

What the Tax Report looks like

Below you can see the results of a test user who had his 2023 tax return calculated and is from the Czech Republic. We can see that the user:

- Sold $802,886 worth of stock in that year, closed out $50,987 worth of Short positions from last year (2022), and by the following year (2024) the value of his un-closed Short positions is $47,524.

- Purchased $803,851 worth of stock in the year, closed out Long positions for $76,211 from last year, and by the following year the value of his un-closed Long positions is $74,710.

- The dividend gain (net of withholding tax paid) is CZK 11,634 (already provided in the user’s currency, this is the exact amount they will add to their tax return).

- Trading profit (after deduction of fees and forex) is CZK 7,929 (already provided in the user’s currency, who will insert the values from Income/Expenses in CZK in the tax return statement for the given year).

You can try the application here. Would you like to see the investment results calculated for your country’s tax return? Are you missing any key features? Let us know and we will expand the application accordingly.