Analytical Platform brings a quant approach to managing your investments. Rely on data, statistics, and proven investment indicators to build your stock portfolio.

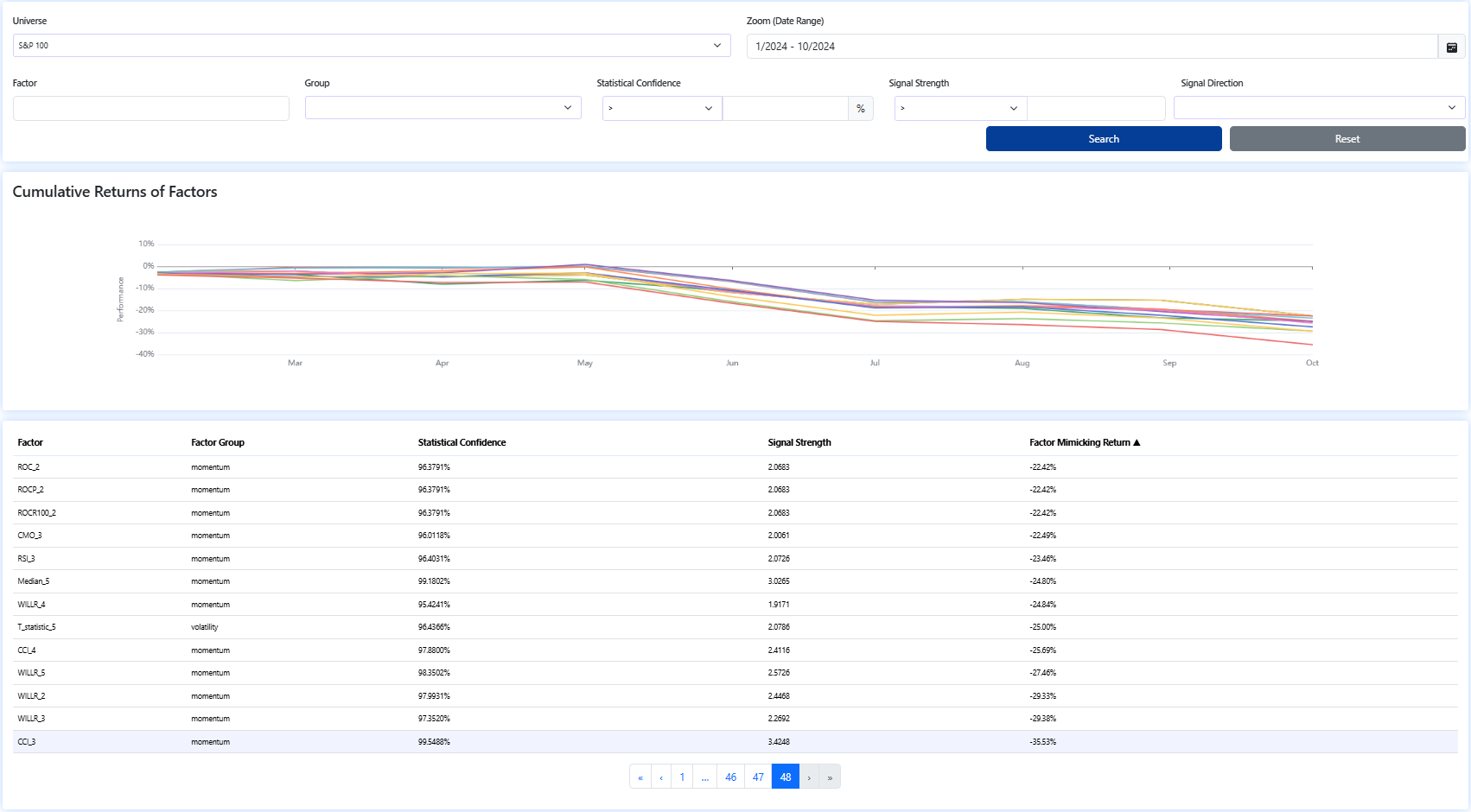

Trending investment indicators

The most profitable investment factor

The most trending factors[1] in the last week have not changed since yesterday. For this reason, we look at statistics that we otherwise show only to our paying users. Namely, we look at the factor that earned the most throughout 2024! It is a CCI 3 indicator that has gained over 35%[2] year-to-date.

Analysis of the indicator CCI 3

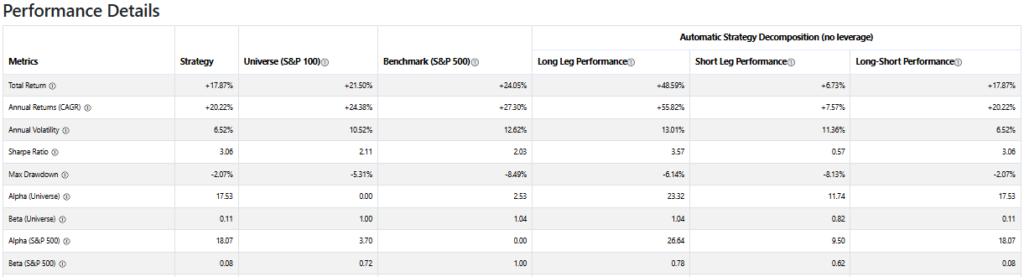

CCI (Commodity Channel Index) from the Momentum category measures the difference between the current price and the average price over a specific period. A high CCI might indicate the price is above its average and vice-versa. Long-term Signal strength (T-Stat) reaches excellent values (3.4248). Statistical confidence is also very high (99.5488%). Signal direction is down, i.e. stocks with low value in the indicator outperform those with high value. Thus, CCI 3 is a statistically significant factor in the long run and in 2024 this is more than confirmed.

If we created a strategy in which we reinvest gains/losses, the YTD performance of the Market-neutral portfolio would be around 18%. However, if we were to buy only stocks with the lowest CCI 3 value, the Total YTD Return would be 49%, the volatility would be similar to our benchmark, and the maximum drawdown would be even lower.

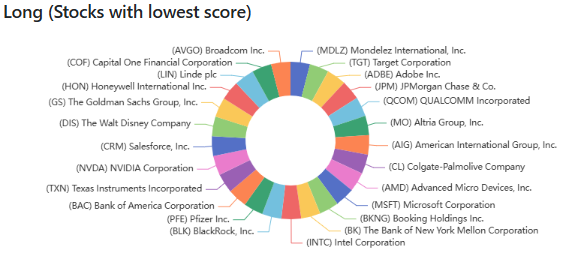

Stocks with the lowest indicator value

In the calculation for November 2024, MDLZ (Mondelez International), TGT (Target Corporation), and ADBE (Adobe) have the lowest factor value within the S&P 100 universe.

In the Factor investing app, you can find over 1,000 investment indicators and their values for all S&P 500 stocks.

Trending stocks

The most trending ticker[3] in terms of the number of articles written is ADANIPOWER.NS (Adani Power Limited). The company also holds this position regarding the change in negative articles. The biggest change in the number of positive articles over the past week has been seen by BKKT (Bakkt Holdings). The number of articles about the company increased 10 times and the ratio of positive ones increased by more than 10%.

You can find all trends, articles, and sentiments for each stock in the Market Sentiment app for free.

Register today & enjoy one month

FREE trial of our application

[1] Trending investment indicators are calculated on the S&P 100 universe; data from November 21, 2024.

[2] The portfolio consists of buying 20 stocks with the lowest value for this indicator and selling stocks with the highest value for this indicator at the same price (we form a so-called market-neutral portfolio).

[3] Trending stocks are based on the approximately 60,000 tickers found in the analyzed articles.