Factor strategies are designed to assist institutional investors in capturing excess returns of systematic factors (investment indicators). A wide range of financial factors is available, more than 10,000 in total, with new ones added every day. These indicators take into account various drivers, including company-specific data such as fundamentals, as well as macroeconomic market conditions.

The most straightforward option for factor strategy is single-factor. A multi-factor linear strategy can be built on top of these. The highest level is the multi-factor non-linear strategy. Let’s look at the choices in more detail.

Single-factor strategy

It captures the returns of factors that have historically earned a premium over a broad market. Single-factor investing helps us to understand investment indicators in detail and use them based on accurate backtests, not on rigid lectures.

The evaluation of the statistical significance of the factor is important. For instance, we can look at whether investing in stocks with a high Free cash flow has produced good results only randomly and in the short term, or whether the results are based on a long-term statistically significant trend.

In practice, we can examine how each indicator works and the ideal values. Let’s see if stocks with low or high Free Cash Flow grow more in price in the long run or what values make stocks grow the fastest.

Multi-factor linear strategy

It provides investors with exposure to factors from other classes such as Momentum, Quality, Size, and others. A multi-factor portfolio allows us to create a more robust strategy by combining investment indicators.

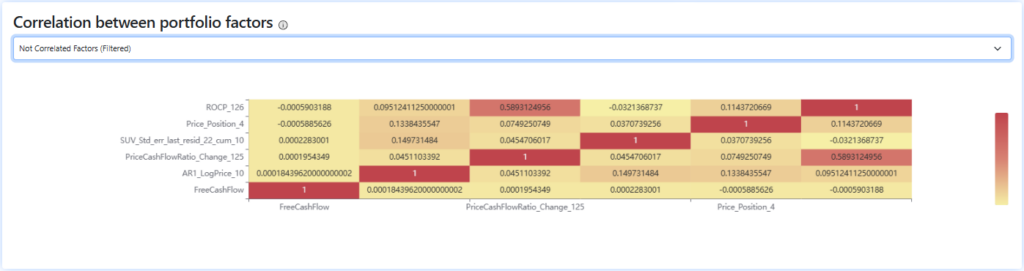

For example, we can use the desired factor and find other significant uncorrelated factors to it, thus creating, let’s say, a three-factor portfolio. To build a linear investment model, we can use artificial intelligence to help us combine uncorrelated factors according to a predetermined fitness function. The models can be based on factor preselection, i.e. the AI model a) considers only statistically significant factors or b) takes into account also statistically insignificant factors. Read more.

Multi-factor non-linear strategy

A non-linear model enables finding relationships that humans are unable to discern and thus achieve investment objectives more efficiently. E.g. Sales per share does not have a direct effect on stock returns and, therefore, has a low P-value and T-stat (statistical confidence), but it has an effect on other factors that already have that effect => this is the non-linear relationship. An example of such a model is xgBoost, which we use in our StockPicking Lab. Read more.

Creation of factor strategies

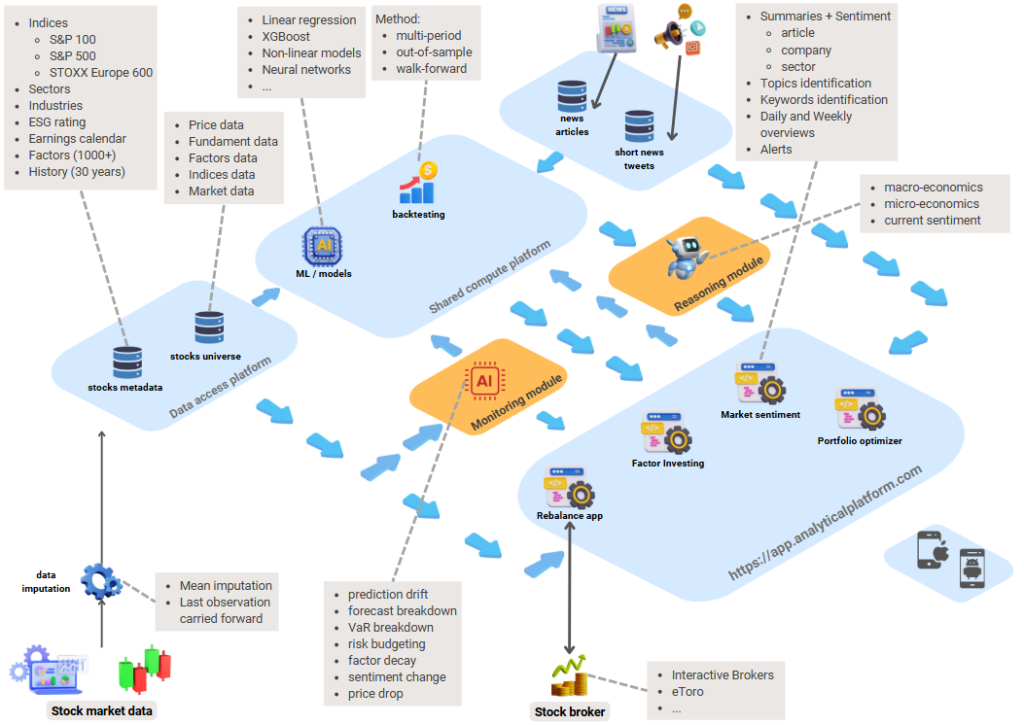

Analytical Platform allows you to apply factor strategies in a transparent and fully automated way.

The explainability of strategies and their continuous monitoring is crucial. Therefore, we will be adding dedicated Reasoning and Monitoring modules to the Analytical Platform to help increase the adoption of non-linear investment models.