Build your stock portfolio/index/ETF based on proven investment indicators and theories using Analytical Platform’s automation software.

MARKET DRIVERS

A wide range of financial indicators (factors) is available, more than 10,000 in total, with new ones added every day. These indicators take into account various drivers, including company-specific data such as fundamentals, as well as macroeconomic market conditions.

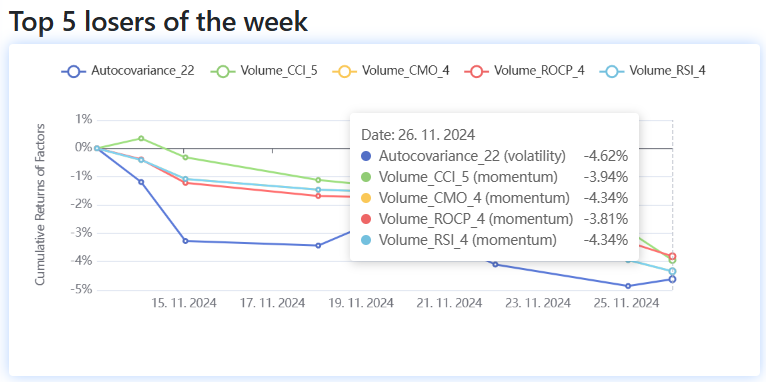

We publish reports describing which factors have earned the most in the previous 5 trading days (see our Blog). In our app, you can find reliable long-term profitable factors with good T-Statistic and P-Value.

Register today & enjoy one month

FREE trial of our application

HOW TO UTILIZE MARKET DRIVERS IN INVESTING

The most straightforward option is to create a Single-factor strategy. A multi-factor strategy can be built on top of these, and the highest level is a multi-factor strategy, where artificial intelligence helps select the combination of factors.

To make factor investing accessible to a wide range of analysts and portfolio managers, we have been publishing a series of educational articles.

MOST PERFORMING INDICATORS IN 2024

What is the most profitable investment indicator for stock selection in 2024?

RSI? ADX? WILLR? EMA?

Nope, but you will discover it in our article. Read more.

STOCK SCREENER VS. FACTOR ANALYSIS

Two prominent tools stand out when evaluating investment strategies. Factor analysis and stock screener. Both serve the purpose of identifying potential stock investments but differ in methodology, depth, and application. In this article I will explore the differences between the two, and how investors can use these tools to enhance their portfolio performance. Read more.