We have finally released the production version of our groundbreaking Factor investing software. Therefore, the current edition of our newsletter (the 10th TAOTS in 2024) will focus on what this new software offers you.

FACTOR INVESTING SOFTWARE

Factors are more commonly known as investment indicators, investment ratios or investment metrics.

According to factors, you’ll get stocks best fitting your portfolio, but that’s just the tip of the iceberg. The Analytical Platform is a holistic application that empowers you to find worthwhile factors and manage your investment portfolio through them.

STOCK PORTFOLIO/INDEX/ETF COMPOSITION

The current stock valuation by factor determines the current index/ETF composition.

In our sample case, we chose the Cash Flow per Share factor, which has an excellent Statistical confidence (T-test) of 99.98% ✓ and Signal strength (P-value) of 3.53 ✓. For this indicator, in the long run, the stocks with the lowest value grow faster than those with the highest value, so it has a decreasing Signal Direction.

STOCKS WITH LOWEST SCORE

According to the above strategy, we invest in S&P 500 stocks with the lowest Cash flow per Share.

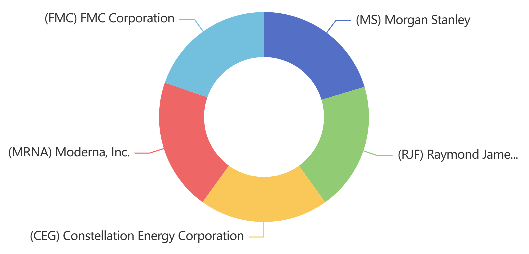

The indicator’s lowest values were observed in November in the following stocks: MS, RFJ, CEG, MRNA, and FMC.

HOW TO UTILIZE FACTORS IN INVESTING?

To make factor investing accessible to a wide range of analysts and portfolio managers, we have published a series of educational articles.

HOW TO CREATE AND MANAGE A FACTOR-BASED INDEX/ETF

Factor-based indexes and ETFs are gaining unprecedented popularity. Assets Under Management (AUM) in them have grown 22 times in the last 5 years! Factors have demonstrated the ability to deliver excess returns or lower volatility compared to passive market cap-weighted indexes. Those are characteristics that active fund managers consistently look for in their research. Read more.

HOW TO APPLY FACTOR INVESTING IN THE REAL INVESTMENT WORLD

This article has been drafted for investment companies and the professional investing community interested in factor investing.

We want to show how factor portfolios can be created using automation for ordinary portfolio managers nowadays. Read more.

Register today & enjoy one month

FREE trial of our application