Dear capital markets enthusiasts, we wish you the greatest possible appreciation of your investments in 2025! We believe that our investment software will help you to achieve the desired results. Build your stock portfolio/index/ETF based on proven investment indicators and theories using Analytical Platform’s automation software.

MARKET DRIVERS

A wide range of financial indicators (factors) is available, more than 10,000 in total, with new ones added every day. These indicators take into account various drivers, including company-specific data such as fundamentals, as well as macroeconomic market conditions.

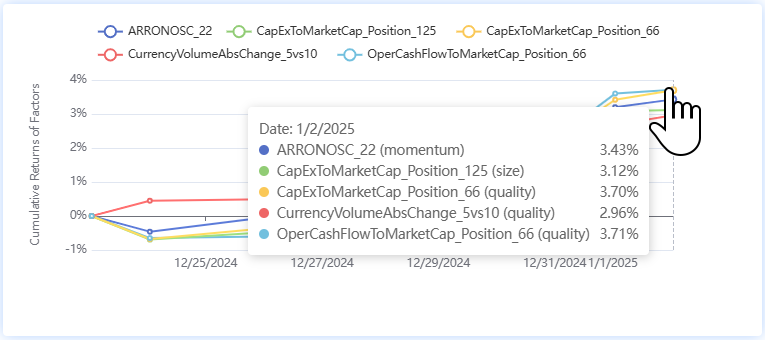

We publish reports describing which factors have earned the most in the previous 5 trading days (see our Blog). In our app, you can find reliable long-term profitable factors with good T-Statistic and P-Value.

TOP 5 GAINERS OF THE WEEK – S&P 100

Over the past week, the market-neutral portfolio of the Operating Cash Flow to Market Cap Position 66 factor earned the most.

OPERATING CASH FLOW TO MARKET CAP POSITION 66 FACTOR

The indicator represents a company’s operating cash flow relative to its market capitalization, specifically denoting where it is located within the 66th percentile position. This can help investors evaluate the quality of a company’s earnings. A higher value may indicate stronger cash flow efficiency and could signify a potentially undervalued stock.

Statistical confidence (P-Value) is within the desired range, and Signal strength (T-Test) is slightly below the target range.

STOCKS WITH THE HIGHEST SCORE

Within the S&P 100 index, the following companies achieved the highest values based on data from 31 December 2024: EMR, LIN, CMCSA, MDT, and AMGN.

HOW TO UTILIZE MARKET DRIVERS IN INVESTING?

The most straightforward option is to create a Single-factor strategy. A multi-factor strategy can be built on top of these, and the highest level is a multi-factor strategy, where artificial intelligence helps select the combination of factors.To make factor investing accessible to a wide range of analysts and portfolio managers, we have been publishing a series of educational articles.

INVESTMENT MYTHBUSTERS – IS IT WORTH BUYING STOCKS WITH HIGH FREE CASH FLOW?

The theory at Investopedia says: ‚Increasing free cash flow to outstanding shares value is a positive, as a company is regarded as improving prospects and more financial & operational flexibility.‘

But how does the price of high FCF stocks grow compared to those with low Free cash flow?

Register today & enjoy one month

FREE trial of our application